FREE NEWSLETTER

THE IRS JUST released a new form called Schedule 1-A, which includes all the new tax bill deductions.

I wanted to quickly go through some of it, so that you are more aware of the new potential savings opportunities.

I’ve previously discussed some portions of the bill, but this is the first time we have a peek of the new lines.

All of these deductions are in addition to the standard deduction or itemized deduction.

All of them are tied to Schedule 1-A, line 3, which pulls your Adjusted Gross Income (AGI) from Form 1040, line 11:

This AGI number is critical. If you’re over certain limits, the deductions below will phase out or “disappear”.

“No tax on tips”

The first deduction on Schedule 1-A is the “no tax on tips”.

If you haven’t received any tips in your job, this of course wouldn’t apply to you. If you receive qualified tips, that amount should be included on Form W-2, box 7, if you are an employee.

You can also deduct qualified tips earned as a self employed person, so make sure to track them (Line 5). This is of course if these tips are qualified, and is from an occupation that “customary and regularly received tips before December 31, 2024”. Here’s a published list from the Treasury of which occupations qualify.

If you earn more than $150,000 single or $300,000 married (from line 3), the maximum allowable tip deduction will be reduced by $100 for each $1,000 over (line 9-12). For example, a single filer with $155,000 AGI would see the maximum tip deduction ($25,000) reduced by $500.

“No tax on overtime”

To get the “qualified overtime compensation deduction” your overtime must be “qualified”. The IRS hasn’t posted any instructions yet on Schedule 1-A, but based on the tax bill we know that the deduction applies to non-exempt employees who receive overtime pay under the federal Fair Labor Standards Act (FLSA). So if you are an exempt employee, this wouldn’t apply to you.

The 2025 tax year is an initial rollout, and more guidance is expected from the IRS soon. 2026 and forward, the IRS will require payroll companies to provide W-2 forms that include that amount.

Similarly to the tips deduction, everything will depend on your income level (Line 3) and the deduction will be phased out if you are over the limit.

“No Tax on Car Loan Interest”

If you have an applicable passenger vehicle (acquired in 2025 or after, must have been new, and assembled in the US), you can deduct qualified interest. You would have to provide the VIN for the car(s). The lender will be required to provide that information via an informational form (like Form 1098).

If you are over the $100,000 or $200,000 (married jointly), the maximum $10,000 loan interest deduction is phased out. See my recent post for more details.

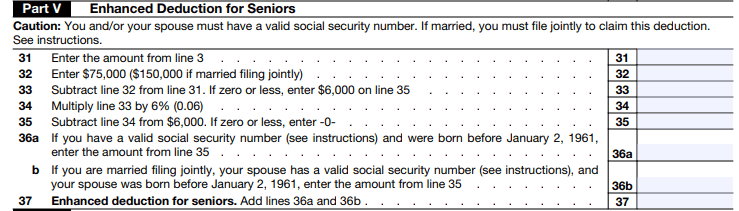

“Enhanced Deduction for Seniors”

If you are 65 or over, you can receive a $6,000 deduction if Line 3 is below $75,000 single or $150,000 married filing jointly. If it’s over the threshold, it will be reduced by 6%. If your spouse is also 65 or older, they will receive the same amount.

For example, a single 70-year-old with $80,000 AGI on Line 3 would see their deduction reduced by $300 (6% of $5,000).

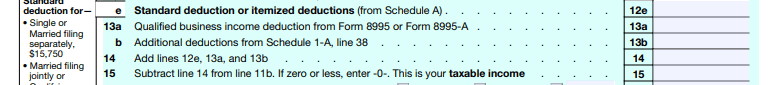

All of these deductions are summarized and entered on Line 13b of your Form 1040:

The deduction will reduce your taxable income, which lowers your federal income tax bill.

It is still uncertain which states will conform to the federal changes. For example, the governor of Colorado is trying to analyze the impact of $1.2B revenue loss due to conformity to the federal rules.

I would expect more lobbying happening over the next few months to determine which provisions the states would conform to, likely many business provisions (e.g. 100% bonus depreciation) will be enacted.

If not, even though certain items will be deductible on the federal level (like car loan interest), it might be added back to the income for state purposes. More details to come.

![]() Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.

Thank you for this forward-looking update of what’s coming. I appreciate your no-nonsense tax related focus.

Many of us will have no use for the Schedule 1-A. I believe this is better situated for the younger crowd. Sure seems to me it should help many. Keep us posted on all the changes, thanks.

With millions of the U.S. population being age 65 or older as of 2025 my expectation is that a large majority of that group that have taxable income below the threshold will receive a tax benefit from completing part V, Enhanced Deduction for Seniors, using the new schedule 1-A during tax years 2025-2028. I know I am including that deduction in my 2025 year end tax planning decisions.

It will be interesting to see if tax software will print schedule 1-A for those with no tax benefit from the senior deduction.

Much like alternative minimum tax calculations, I expect tax software and tax preparers will be making the calculation regardless if there is a benefit or not.

I just ran through the Deduction for Seniors calculation. It will directly reduce your AGI. The 1040 will also have to be updated as items from Schedule 1-A are going to pull over to new line items on the 1040. For instance, this deduction will get reported on 1040 line 13b. The 2024 1040 does not have a line 13a or 13b! Oh this will be so much fun for everyone!

I would reference you to the the 2025 draft 1040 on the IRS website. Per that draft the senior deduction 13b is below the adjusted gross income line, much like the distance past personal deduction line before the TCJA reduced the personal exemption deduction amounts to zero.

I agree the OBBBA will complicate taxes and tax planning for all of us, and 2025 is not yet over. There is a reason amusement parks put a grab bar on the roller coasters.

Great summary of these changes, Bogdan! One question: you noted “It is still uncertain which states will conform to the federal changes”. On the federal tax form, how could a state or states NOT “conform”?

“On the federal tax form, how could a state or states NOT “conform”?”

By not allowing the new federal changes to “flow through” to any particular state’s income tax form. For example, several states tax capital gains, even though they may not be taxed on the federal form; similarly, many states have their own formulas for setting a standard deduction that’s different than what’s used on the federal return, and so on.

Thanks! Nice Summary.